BEBECONFORT Soft Dreams Lit parapluie, Lit bébé de voyage, De la naissance à 3 ans (jusqu'à 15kg), Happy Days - Cdiscount Puériculture & Eveil bébé

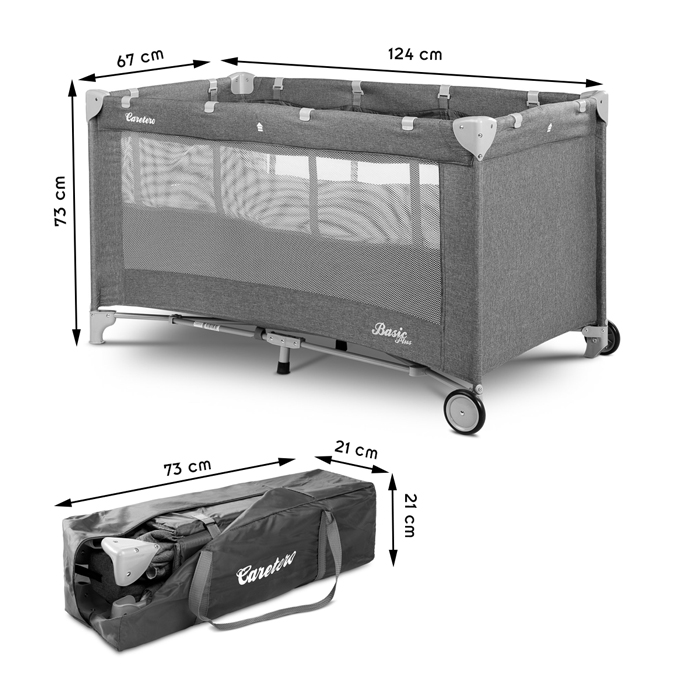

Leogreen - Lit Parapluie Bébé, Lit de Voyage bébé Pliable, Standard CE, Pliable, Léger, Orange/Marron, Taille déployée: 125 x 76 x 65 cm, Poids: 8,84 kg : Amazon.fr: Bébé et Puériculture