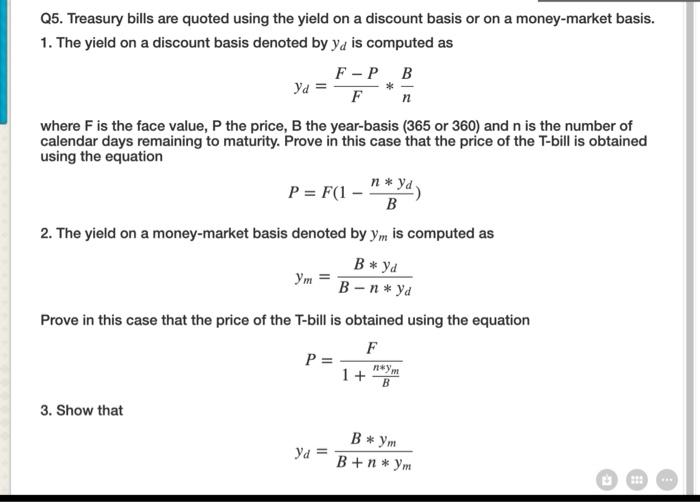

Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis-3-Month Treasury Bill Secondary Market Rate, Discount Basis | FRED | St. Louis Fed

Copyright © 2014 Pearson Canada Inc. Chapter 4 UNDERSTANDING INTEREST RATES Mishkin/Serletis The Economics of Money, Banking, and Financial Markets Fifth. - ppt download

Bond Pricing P B =Price of the bond C t = interest or coupon payments T= number of periods to maturity r= semi-annual discount rate or the semi-annual. - ppt download

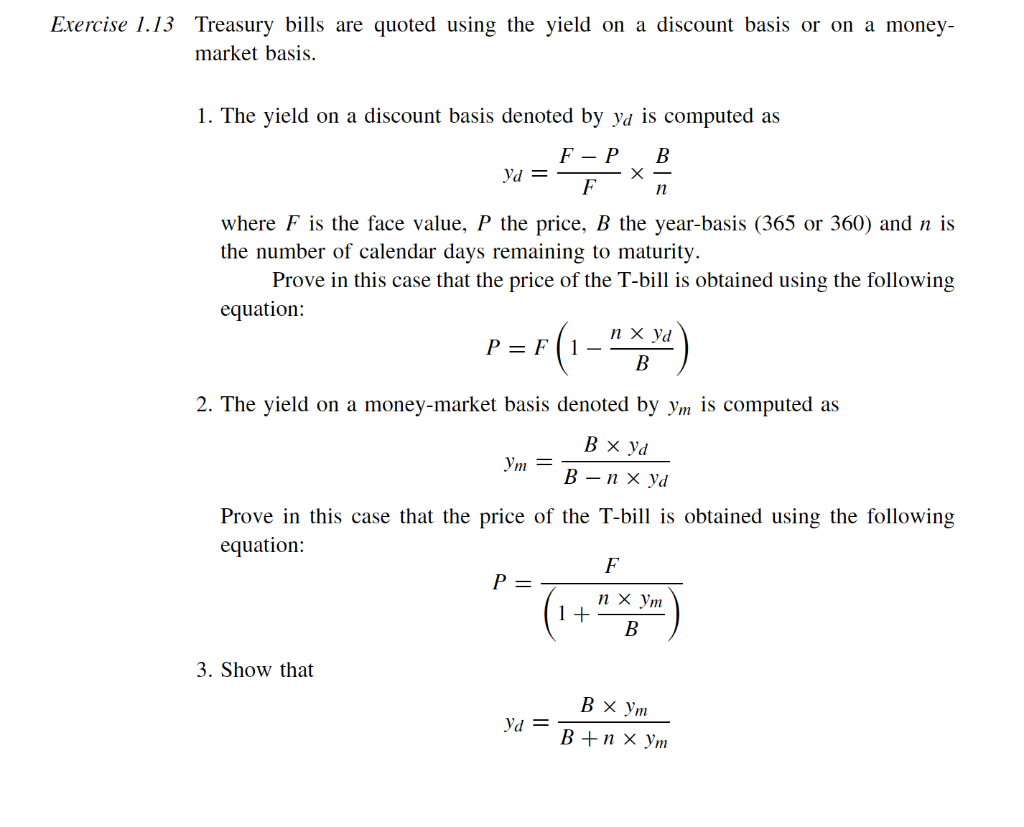

The yield on a discount basis of a 90-day, $1,000 Treasury bill selling for $950 is - The yield on a discount basis of a 90-day, $1,000 Treasury bill | Course Hero

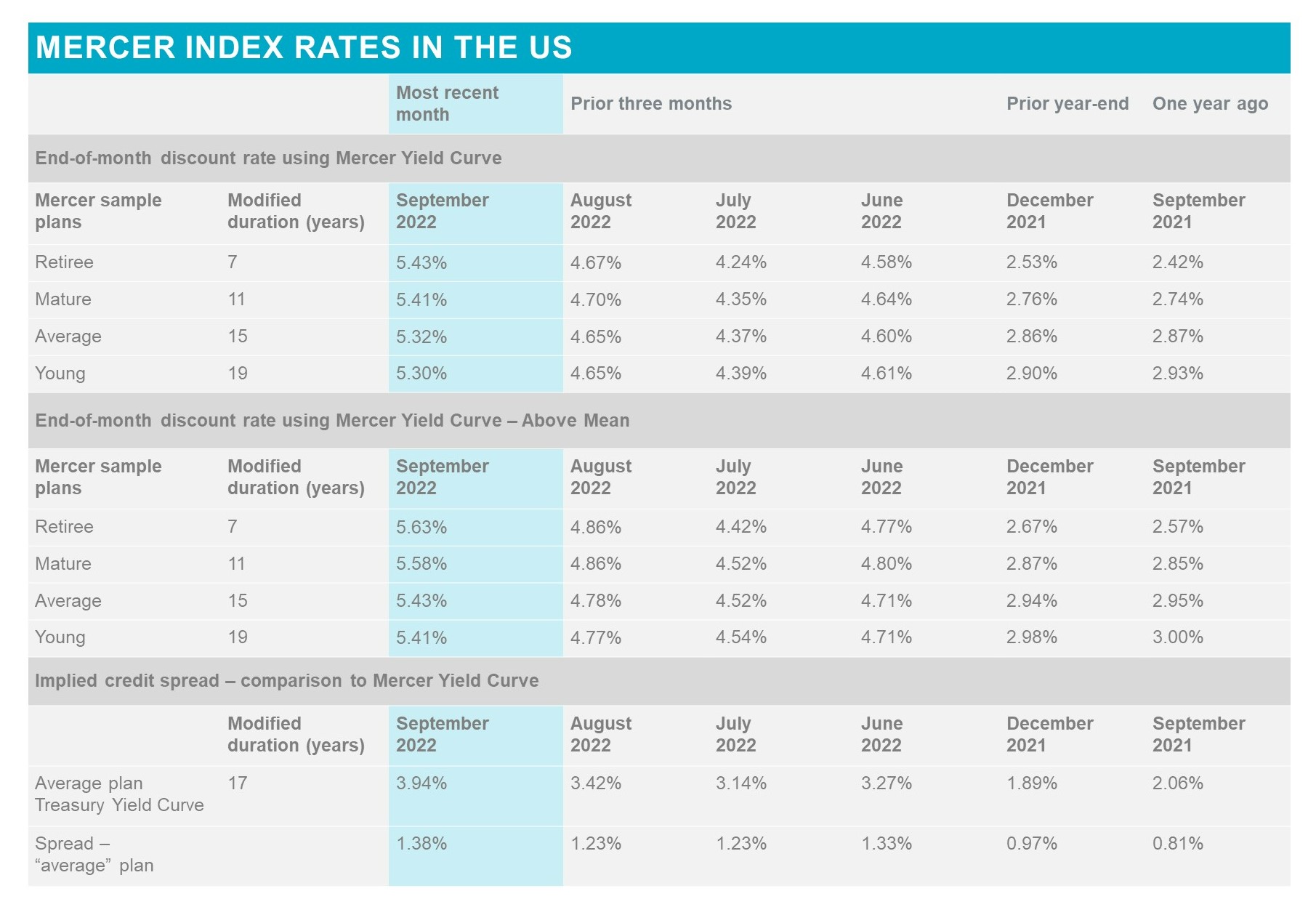

1 Chapter 2 MONEY MARKETS. 2 Money Markets-Definition Markets for short term debt (maturity less than 1 year). Bear low credit and price risks. Thus, - ppt download

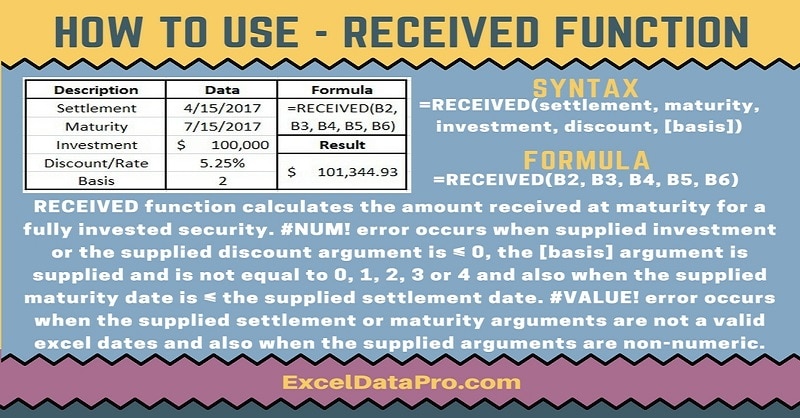

calculate and interpret the bank discount yield, holding period yield, effective annual yield, - YouTube