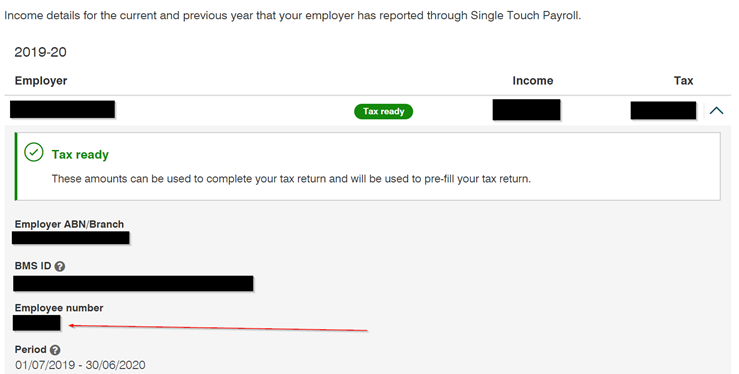

📣 myGov has a new look! The updated myGov has more features and info about government services, but doesn't change the way you: ✔️ sign in ✔️ access ATO... | By Australian

Two Income Statements in MyGov account (one 'Tax ready' and one 'Not Tax Ready') - Reckon Help and Support Centre